15 Benefits & Special Programs Retirees Are Using To Save $1000’s

Recent study shows that 78% of Americans have never used these special programs. Most are missing out simply because they don’t know these programs exist. That’s why we put together this list of the top programs available for people over 50.

On average Americans can put an extra $5,000 back into their pockets this year simply by using the special programs listed below.

1. Owe More Than $20,000 in Credit Card Debt or Personal Loans? Use This Brilliant Debt Relief Program

Because of the pandemic and the skyrocketing cost of living in the United States, more and more people are struggling with financial debt than ever before. And with interest rates snowballing the amount owed, paying your credit card balance can seem like a trap that can never be escaped. Thankfully, there’s a solution:

If you owe more than $20,000 in credit card debt or personal loans, this proven debt relief program available can greatly reduce the amount of money you owe. This program can resolve your debt without a loan – allowing you to become totally debt-free in just 24 – 48 months.

So if you carry $20,000 or more in credit card debt or personal loans, click here to see if you qualify for reduced payments!

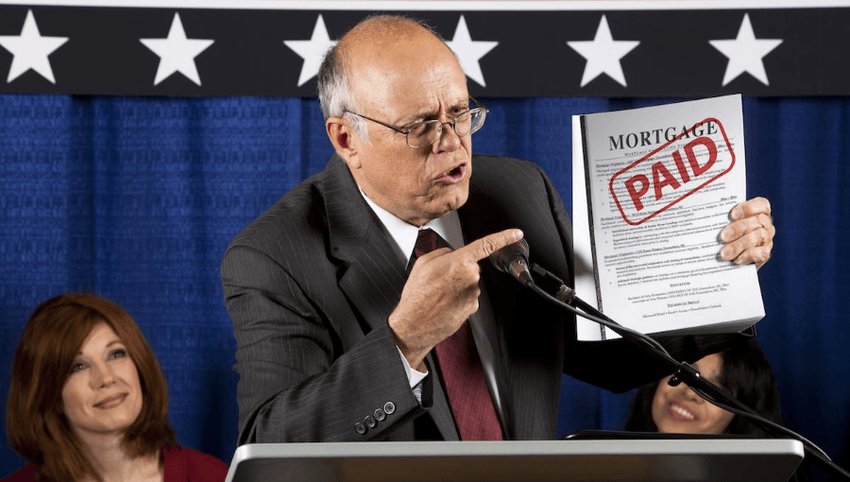

Click Here To Learn More2. Government Stimulus Program Gives $3,252 Each Year In House Payment Reduction

Millions of homeowners are getting huge savings on their monthly mortgage bill thanks to the new Federal Mortgage Stimulus program, and not surprisingly banks aren’t too happy about that.

When homeowners visit FEDRateWatch.org website they are surprised to find out they qualify for a free government program that lowers their mortgage to astonishingly low rates and can reduce their mortgage payment by $3,252/year ($271/month) as early as this December.

Homeowners that owe less than $625,000 will likely qualify for this brilliant government program. There’s no telling how soon this program will expire, so it’s suggested that homeowners complete the mortgage stimulus survey to check their eligibility right away. While the banks happily wait for the program to end, homeowners are advised to act quickly.

Most homeowners will qualify for this program and the process is very simple. So if reducing your payments by $271/month, paying off your mortgage faster, or even taking some cash out would help you, it’s important to check your eligibility here. Checking your eligibility is quick and completely free!

See If You Qualify For a Mortgage Reduction3. Get a Discount On Your Car Insurance (Save $610/year)

Did you know that depending on your age, driving record and many other factors you could get a huge discount on car insurance?

If you’re paying over $50/month for car insurance, there’s a good chance you’re paying more than you need to. Usually most seniors simply keep their same old policy in place every year and those rates can creep up over time without really noticing.

Most seniors are not taking advantage of the multiple discounts available to them when it comes to car insurance. And the reason is that most seniors don’t even know about these discounts. Click here to learn how you can save up to $610 on your car insurance.

Click Here To Learn More4. Over 55? Get a Discount When Eating Out

- Arby’s – 55 and up get a 10% discount or a free drink

- Applebee’s – 60 and up get 10% to 15% off at participating locations.

- McDonald’s: discounts on coffee and beverages (55+)

- Wendy’s: give free coffee or other discounts depending on location (55+)

- Denny’s: offers a 55+ menu with smaller portions, and better prices

- IHOP – 10% discount (55+) and a menu for people aged 55 and over at participating locations

- Subway: 10% off (60+) varies by location

- KFC: free small drink with any meal depending on location (55+)

- Burger King: 10% discount on purchase depending on location (60+)

5. Homeowners In Eligible Zip Codes Get $1,632/yr Back On Their Home Insurance

A new special program is helping thousands of savvy homeowners get up-to $1,632/year back on their home insurance. Has your insurance provider told you about this?

Check If Your Zip Code Qualifies Here.

The truth is that everyone needs homeowners insurance, and the insurance companies know that. But how often do you actually get to use your insurance? Most probably not enough to make up for the cost year after year. Home insurance should not be expensive.

Here’s something most people don’t know about home insurance: Homeowners insurance is actually inexpensive, but most people are paying way too much. In fact, most homeowners can now get an average $1,632 taken off their annual bill for the same or even better coverage than they have now at a much lower rate by using this popular website.

In just 30 seconds, you can search available rates from the top insurance providers that compete to give you the lowest rate allowing you to get a big discount on a great coverage. Many readers are reporting that they’re able cut their home insurance in half just by using this free website to compare quotes.

Get My Free Quote Now6. Never Pay For Costly Home Repairs Out-of-Pocket Again

Unexpected home repairs can be catastrophic to the finances of most those who are on a fixed monthly budget. Your home insurance will not cover your refrigerator, stove or washing machine breaking down unexpectedly. Same goes for your heater in the winter or AC unit in the summer, if it breaks, you have to pay the heavy repair bill.

The good news is that there is now a new Home Warranty Program available for US residents that can help protect you from unexpected home repair bills & save you thousands on repairs. Appliances, AC’s, heaters, roofing repairs, etc. – they are all covered under the program. If they cannot fix it, they will replace it, its simple + saving you thousands.

Click Here To Learn More7. Collecting Social Security? Boost Your Benefits by $900 a Month

You could increase your Social Security benefits by $900 a month by taking advantage of a do-over strategy. A little-known tax law allows you to halt your current benefits, pay back all you collected interest-free, and restart your benefits at a new, much higher rate based on your current age.

Here’s how it works: Let’s say you qualify for full benefits of $1,600 a month at your normal retirement age of 66, but you decide to begin collecting your benefits at 62. Your retirement benefits will be reduced by 25% for the rest of your life — to $1,200 a month, in this example — because you’ll be collecting a smaller benefit for a longer period of time. On the other hand, if you delay collecting benefits, you will receive an 8% credit for every year beyond your normal retirement age until you reach 70, when your maximum benefit will be 132% of what you would have received at age 66. In this example, you would receive about $2,100 a month at 70 — a $900 difference. Be sure to crunch the numbers and speak with a qualified advisor to make sure this is the right decision for you.

8. Never Pay Another Electric Bill Again — Federal Program Pays Homeowners To Go Solar And Enjoy $0 Electric Bills

Here’s what your power company doesn’t want you to know. A little-known government program allows qualified homeowners who live in these specific zip codes to receive $1,000’s in Government funding to install solar panels.

The program is called the Federal Residential Renewable Energy Tax Credit, which provides subsidies and rebates that can cover most of the costs associated with installing solar panels. In fact, the average tax break gives back $6,280 for installing solar panels.

Has your power company told you that? Probably not. Once homeowners go solar, their energy bill is drastically reduced — often to $0 or close to it. You can bet the power companies are not happy about that.

Homeowners can check to see if their zip code qualifies here before the program expires and never pay their electric bills ever again.

Check If My Home Qualifies9. Drugstore Discounts

- CVS Pharmacy: Those enrolled in the CVS ExtraCare Savings and Rewards program can save more with coupons in-store and online via the ExtraCare Coupon Center. As you shop and fill prescriptions, you also earn ExtraBucks Rewards.

- Rite Aid: You can get 20% off brand-name and generic prescription drugs with the Rite Aid Rx Savings Program. Sign up today and get an Rx Savings Card that will give you access to thousands of exclusive discounts at Rite Aid pharmacies!

- Costco Member Prescription Program: You and your family members can save up to 80% (at time of sale) with the Costco Member Prescription Program. If you have no prescription drug insurance, or if you do and it does not cover all your prescription medications – this the program that will help you save loads.

- Narcup: If you don’t have prescription drug insurance (or if it doesn’t cover all your medications), get the Narcup prescription discount card for free and save up to 50% on FDA approved drugs. Good to know – they also cover certain pet medications!

- Kmart: To get covered for most generic drugs (starting at $5 for a 30-day supply or at $10 for a 90-day supply), 10% of pet prescription and 25% off vaccinations join the Prescription Savings Club at Kmart (Pharmacy Savings Plus). It will cost you only $15 per household or $10 per person (annually).

- Walgreens Prescription Savings Club: Get exclusive discounts and special offers with your Prescription Savings Club Card. Membership fee – $20/person or $35/household annually. The best part – if you don’t save at least the cost if your membership fee, Walgreens will pay you the difference!

- Walmart Pharmacy Services: The company offers low-cost generic prescription medications, $4 refills for generics, branded drugs, and even pet medications. Check Walmart drug list to see how much you can save on your medications.

10. Special Program Gives $250,000 In Life Insurance For Just $15/month

So we all know, that if you have any family, you need to have life insurance. A good policy could easily cover mortgage, living expenses and pay for final expenses while ensuring your loved ones don’t inherit your debts. Pretty much everyone knows that having life insurance is much better than not having it.

But do you know that due to new program policies, it’s now easy to qualify for $250,000 life insurance policy at an extremely low monthly rate? And that plans with guaranteed acceptance for any age and no medical exam are available?

The truth is that life insurance rates are at a 20-year low. But I bet your local life insurance agent won’t tell you that. And due to the internet, things are changing for the better. Thanks to this new website there is now a way to get a very solid, yet very inexpensive life insurance policy for pennies on the dollar.

This amazing website is being called “the Amazon of life insurance” and it allows you to see and compare plans, regardless of your age or medical history. They actually make insurance companies compete for your business to give you their very best rates. People are shocked at the results they find. Most can’t believe that the available rates are real and the best part is it’s totally free!

Even if you already have a policy, you can find comparable plans at a much much lower price. You could easily end up saving 70% on life insurance just by using this free website!

No medical check and instant approval policies are also available for any age and even if you have been denied in the past.

Get Cheap Life Insurance11. Home Improvement Programs For Seniors

The U.S Department of Energy’s Weatherization Assistance Program modifies the appliances in your home to make them more energy efficient. The average household saves $283 a year on energy. Preference for eligibility is given to people over the age of 60, and families with one or more members with a disability. Utilities and general maintenance are things you’ll have to deal with even if you’ve paid off your mortgage.

The section 504 Home Repair Program provides a grant of up to $7,500 to senior homeowners to repair damages that are deemed hazardous to safety and health.

If you’re having trouble with rent, look into the Housing Choice Vouchers Program. Formerly known as Section 8, this program provides subsidies to low-income families and the elderly to help pay for rent.

12. New “Roof Replacement” Program Helps Homeowners Get a New Roof

Homeowners should never have to pay full price for roof repairs again. In the past roofing work would cost a fortune. Worse yet, a bad roof can lead to tremendous damage, mold, animal infestation and other expensive situations that could be avoided with proper home maintenance.

No doubt replacing a home’s roof is an easy thing to put off “until next season,” especially since traditionally the cost could come with quite the price tag.

But thanks to this brilliant new website, it no longer has to cost homeowners an arm and a leg to get the roof replaced or repaired. In fact, homeowners that use the site will never have to pay full price for roof repairs again.

Now homeowners can get their roof replaced while saving thousands of dollars in the process by taking advantage of all special discounts, rebates and incentives available in their area.

Every homeowner should check to see how cheap it can be to get a new roof in their area.

Enter ZIP to Check Eligibility Here

Check If My Home Qualifies13. Shopping Discounts

- Banana Republic: 10% off (62+)

- Bealls: 50% off every Tuesday (50+)

- Belk: Get 15% off on the first Tuesday of every month (62+)

- Bon-Ton Department Stores: Get 15% off on senior discount days, 20% off if you use a Bon-Ton credit card.

- Big Lots: Some locations offer discount savings cards. Some locations offer up to 10 percent off through their discount programs.

- C.J. Banks/Christopher Banks: 10% off every Wednesday (60+)

- Clarks: 10% off (62+)

- Dirt Cheap: Dirt Cheap offers a 10% in-store discount every Tuesday to seniors over 60 years of age with valid ID. Available at participating stores

- Goodwill: 10-20% off one day a week, varies by location (55+)

- Hallmark: 10% off one day a week (date varies by location; age may vary depending on the product)

- Kohl’s: 15% off (60+) on Wednesdays, in store only.

- Home Depot: Home Depot does not offer specific senior discounts. However, it does price match the discounts that other retailers may offer for the same product in their location. (10%) discount is offered in the U.S. to all active duty military personnel, reservists, retired or disabled veterans and their immediate families.This discount is applicable up to a $500 purchase.

- iParty: 10% senior discount every day; ask for a discount as soon as you get to the checker

- Lowe’s: Veteran seniors receive 10 percent off of eligible purchases

- Marshall’s: Marshall’s provides seniors with limited discounts. Special offers may be available at some locations.Kmart: A limited number of stores still offer the senior discount of 40 percent off on Wednesdays for seniors over 50.

- Michael’s: 10% off your entire purchase every day (55+).

- Ross Stores: 10% off every Tuesday (55+)

- Savers: Many locations offer discounts, up to 10 percent. However, some do not offer any discounts to shoppers.

- Stein Mart: 20% off red dot/clearance items first Monday of the month (55+)

- Tanger Outlets: 10% discount on a single purchase every Tuesday to seniors who are 55 or older. Only valid in participating locations

- Target: Limited access to senior discounts is available at Target. However, some locations may offer discounts on specific days for various events.

- The Salvation Army Thrift Stores: Up to 50% off, days vary (55+)

- Walgreens: “Seniors Day” once a month, varying by location. Discounts are available for Balance Rewards card members (55+). Discounts include 20% off in store or 10% off online.

- Walmart: Walmart offers very few discounts to seniors. Some locations can offer reduced costs to seniors some days each week.

14. Get a Discount On Groceries If You’re Over 55

If you’re over 55 here are some stores that give a regular senior discount – you just need to ask.

- Albertsons: On the first Wednesday of every month, you may take 10% off your Albertsons purchase (55+)

- Kohl’s: 15% off on Wednesdays (60+)

- American Discount Stores: For seniors 62 or more 10% off every Monday.

- Bi-Lo Senior Discounts: 5% off every Wednesday for customers 60 or older.

- Compare Foods Supermarket: 10% off every Wednesday (60+).

- DeCicco Family Markets: 5% off every Wednesday (60+).

- 3Fred Meyer Senior Discount: 10% – 15%, depending on department, first Tuesday of each month for customers 55 or older.

- Fry’s Food Stores: 10% off on the first Wednesday of every month (55 +).

- Harris Teeter: 5% off every Thursday (60+).

- New Seasons: 10% off every Wednesday most items (65+), 10% off every Tuesday for military.

- Uncle Guiseppe’s Marketplace: 5% off (65+ on Wednesdays)

15. Travel Discounts

- American Airlines: There are various senior discounts that apply to various trips. Call to find out which are available.

- Amtrak: Senior pricing is available for most Amtrak locations. This ranges from 10 to 15 percent off.

- Southwest Airlines: Seniors over 65 who are traveling with Southwest Airlines may be eligible for Senior Fares. These are available online and for international and domestic travel. You can also purchase Senior Fares through a customer service representative at the airline or a travel agency. You will need to arrive early at the gate to be able to prove your age in order to be checked in for your flight.

- United Airlines: United offers discounted prices for flights for seniors over 65. Seniors need to select the Over 65 category when purchasing tickets online or with a customer service agent. Discounts vary depending on the flight and location.

- Marriott – 15% discount (62+). You can book online or call and ask for the senior discount

- Choice Hotels – 10% discount if you book in advance (60+)

- Hyatt Hotels – up to 50% off in participating locations. To qualify for this deal you have to make a reservation in advance and book for two people (60+)

- La Quinta – varying offers at participating locations (65+). Book online or call and ask for senior discounts

That’s it! These Special Programs Can Easily Save You $1000’s Of Dollars Every Year. Claim Before They Expire This December

Claim and start saving right now:

1. Get Rid Of Your Credit Card Debt If You Owe More Than $20,000

2. Claim $250,000 In Life Insurance For $15/month

3. Get $3,252 Each Year In House Payment Reduction

4. Save $610 On Your Car Insurance

5. Never Pay For Home Repairs Out-of-pocket again!

6. Go Solar And Reduce Your Electric Bill To $0

7. Cut Your Home Insurance In Half For Free!

8. Never Pay Full Price For Roof Repairs Again